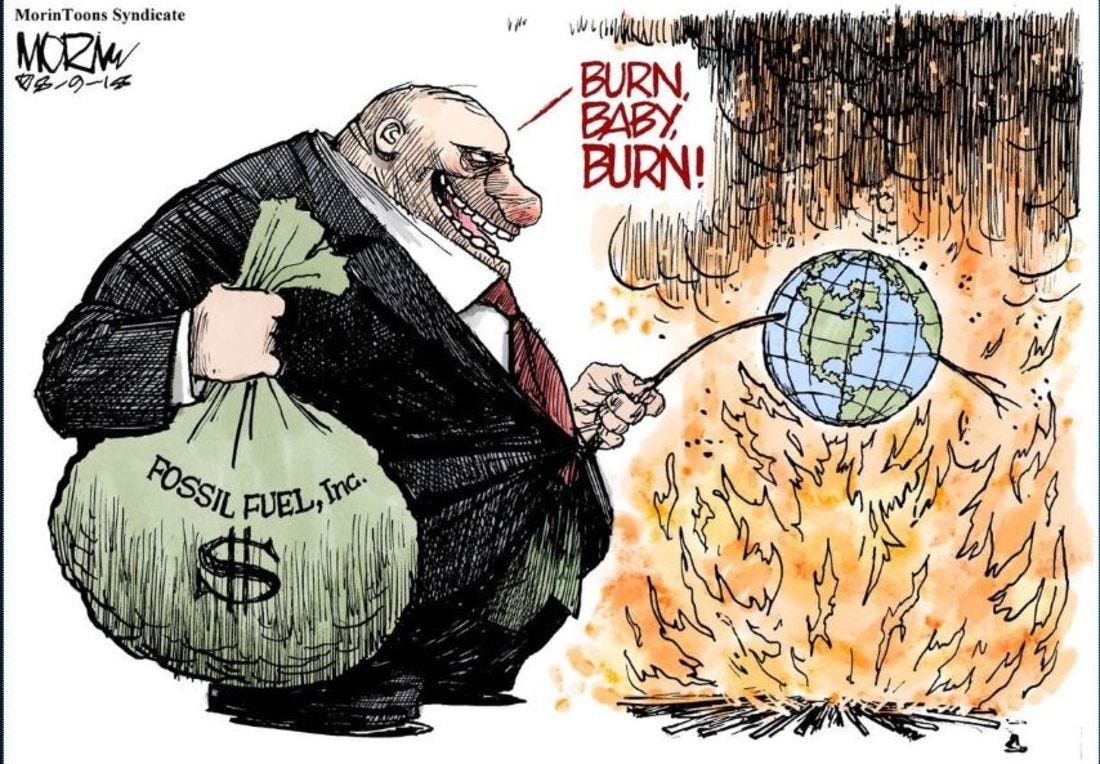

The oil giant’s massive plan to drill in Guyana’s waters comes as the UN Secretary General warns of fossil fuels as a “blight on investment portfolios.”

Investing in new fossil fuel infrastructure is moral and economic madness… Such investments will soon be stranded assets, a blot on the landscape, and a blight on investment portfolios.

UN Secretary-General António Guterres

That same day, oil giant ExxonMobil made an announcement of its own: a $10 billion final investment decision for an oil and gas development project in the South American nation of Guyana that the company said would allow it to add a quarter of a million barrels of oil a day to its production in 2025.

The IPCC’s call to action was urgent.

“We are on a fast track to climate disaster,” Guterres said, reciting a list of consequences that have become all too familiar over the past few years — and warning of worse to come. “Major cities under water. Unprecedented heatwaves. Terrifying storms. Widespread water shortages. The extinction of a million species of plants and animals. This is not fiction or exaggeration. It is what science tells us will result from our current energy policies.”

The IPCC’s report marked the end of an era for fossil fuel producers, some observers said, establishing that, as The Guardian put it, the world has seen “a century of rising emissions [that] must end before 2025 to keep global heating under 1.5C, beyond which severe impacts will increase further, hurting billions of people.”

The disconnect between the two announcements, suggesting two markedly different trajectories for 2025, seems all the more glaring given that ExxonMobil itself has been an active participant in the IPCC “since its inception in 1988,” as the company wrote in a 2021 report. Exxon’s announcement that it plans to continue to pour billions of dollars into nonetheless expanding fossil fuel production — not just in Guyana but around the world — sends a strong message about the direction the company plans to steer, despite the warnings flowing from the IPCC, with consequences for us all.

Meanwhile, company executives sought to frame Exxon’s $10 billion investment in the Yellowtail offshore drilling project in Guyanese waters as part of the “energy transition,” a phrase that’s commonly used to refer to the shift away from fossil fuels to renewables.

“Yellowtail’s development further demonstrates the successful partnership between ExxonMobil and Guyana, and helps provide the world with another reliable source of energy to meet future demand and ensure a secure energy transition,”

It does not take much in the way of observational skills to notice that the war in Ukraine has give big bad fossil fuel companies a new lease on life. The leaky but tightening embargoes and self-sanctions on Russian oil and gas are leading to balkanized markets, as well as inefficient usage

Eves Smith, Naked Capitalism