Despite headwinds related to the ongoing pandemic, we see signs that the U.S. economy’s growth endures.

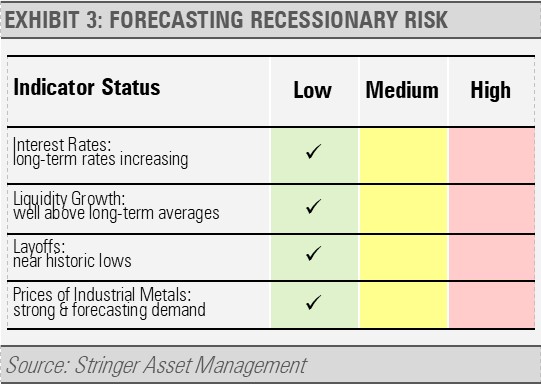

Instead, we prefer to look at the 6-month moving average jobs creation numbers that smooths out the data and helps put recent trends into context. As the following graph illustrates, the 6-month average jobs creation remains well above the average during economic expansions since 2000. This 6-month moving average includes the huge 708,000 jobs upside revision from the November and December reports, which would be missed if only looking at the headline for January.

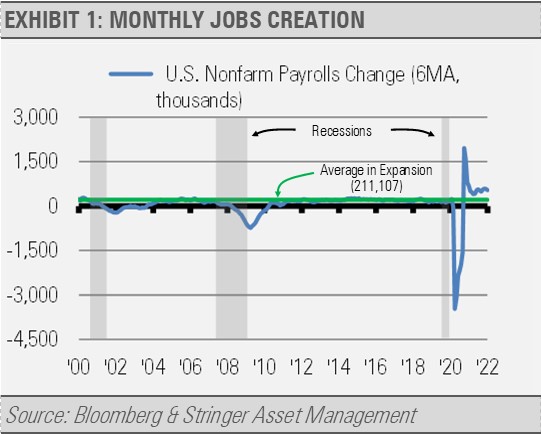

The continued economic momentum and strong jobs creation gives the U.S. Federal Reserve (Fed) the green light for its anticipated policy pivot from supporting growth to taming inflation. Historically, Fed shifts to a tightening policy as well as geopolitical risks have caused equity market volatility. Historically, outside of true recessionary environments these shocks are short-lived and last 40-50 days on average before reversing over a similar time period as the equity market pushes higher over time.

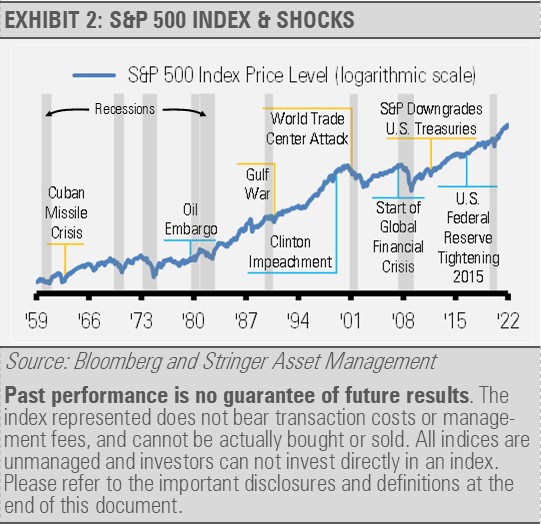

Looking at our broad set of recession risk indicators, none are showing significant signs of risk. These datapoints cover a broad range of economic indicators, such as interest rates, liquidity growth, layoffs, and the trends in the price of industrial metals.